The Hard Market & You – Navigating Insurance During a Sellers Market

The Hard Market & You – Navigating Insurance During a Sellers Market

We are in the midst of the hardest insurance climate in decades.

The combination of high inflation, large claims payouts, and tightening eligibility requirements has forced policy premiums to skyrocket and coverage options to dwindle for insureds.

Insurance experts refer to this situation as a “Hard Market” and here is what you need to know to help navigate it.

Key Takeaways

- Hard market conditions are cyclical. However, their duration is unknown.

- During a hard market, fewer insurers will compete for your business.

- A hard market causes coverage to be more expensive with lower limits and modified terms, leaving you more exposed to uninsured loss.

- Taking steps to reduce your risk can help decrease your premiums or secure better coverage options.

What is a “Hard Market” in Insurance?

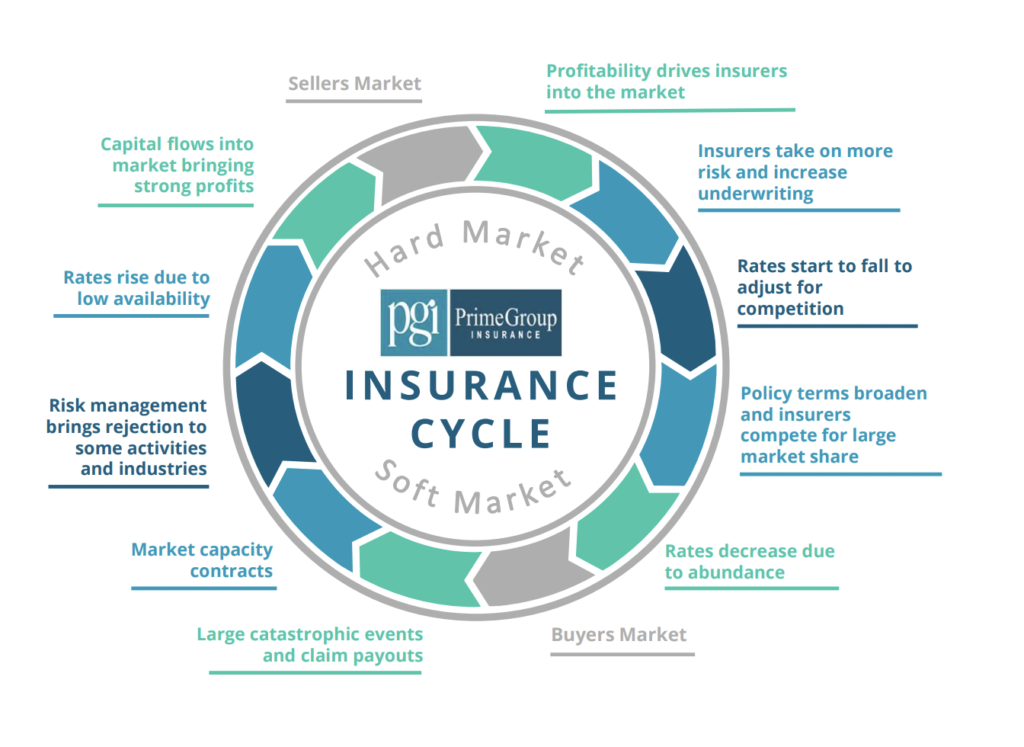

During a hard market, acquiring insurance becomes increasingly difficult and expensive. The Insurance Risk Management Institute summarizes these conditions as a marked increase in premiums and decrease in capacity.1 This leaves the market in the insurance seller’s hands. Insurers become more selective with the risks they take on and charge higher premiums for them.

On the contrary, soft market conditions are favorable to buyers. They are characterized by competitive rates, abundant capacity, and flexible policy terms. Insurers will take on many risks and provide low rates to outrun their ample competition.

It is important to note that the insurance market is cyclical, checked by periods of hard markets and soft markets. The Insurance Information Institute notes that “in the 1950s and 1960s, cycles were regular in three-year periods.”2 After a decade of soft market conditions, the current hard market is sending shock throughout the country as insureds find it difficult to secure coverage at a competitive rate.

What factors cause a hard insurance market?

Risk Strategies describes market hardening being influenced by many factors including economics, politics, and climate events.3

Supply chain issues cause greater materials and labor costs for repair or rebuilding. Larger and more frequent catastrophic weather events trigger grave devastation. Increase in social inflation – in which jurors reward large sums of money at trial – increase unexpected claims payouts. These factors and more force insurers to pay out higher and more frequent claims, affecting their bottom line.4

With less capital available, insurers reduce their breadth of underwriting. They become more selective with what risks they take and where they choose to write. When there is less competition in the area, rates rise and coverage becomes increasingly difficult to obtain, establishing hard market conditions for the insured.4

Navigating the Hard Market – What can you do?

Our job at PrimeGroup Insurance is to make sure you do not have to navigate the hard market alone. There are some steps we advise you take to improve your journey through the hard market.4

- Stay in regular communication with PGI.

- Your Account Manager is dedicated to you and your company’s success.

- Risk management is key.

- By employing proper risk management techniques, you can reduce your exposure.

- Properly document and report anything relevant to claims or policy disputes.

- Plan prior to your renewal.

- Discuss options with your Account Manager ahead of your renewal as coverage may take longer to secure during a hard market.

- Proceed with caution if your agent annually switches carriers.

- During a hard market, insurers might reject “carrier hopping” customers.

- Save costs elsewhere if premium savings are not an option.

- There are other ways to reduce your premium such as taking a higher deductible. Your Account Manager would be pleased to discuss what options work best for you and your business.

Despite the difficult market conditions, PrimeGroup Insurance is here to help you navigate and operate effectively through the hard insurance market. Our Agents and Account Managers are dedicated to helping you conquer this cycle. If you have any questions or concerns, please do not hesitate to contact your Account Manager or reach us at (844) 631-4901 or info@primegroupins.com.

[1] Insurance Risk Management Institute (IRMI). (n.d.). Insurance Definitions – Hard Market. IRMI. https://www.irmi.com/term/insurance-definitions/hard-market [2] Insurance Information Institute (III). (n.d.). Resource Center – Property/Casualty Insurance Cycle. III. https://www.iii.org/resource-center/iii-glossary/P [3] Manzi, M. (2022, December 12). Navigating a Hard Insurance Market. Risk Strategies. https://www.risk-strategies.com/blog/navigating-a-hard-insurance-market [4] The Big I & Trusted Choice. (n.d.). Navigating Client Communications in the Hard Market. Trusted Choice. https://trustedchoice.independentagent.com/hardmarket/IMPORTANT DISCLAIMER:

This article and the contents contained herein are for general informational purposes only. PrimeGroup Insurance makes no warranty to the accuracy or completeness of any information contained within and shall not be liable for reliance on or use of its information as official guidance. This article does not substitute obtaining professional advice, legal advice, or inquiring about such advice. Recommendations contained herein should be vetted against current market conditions, legal, and business considerations before implementing.